3-D Secure Merchant Account

For most high risk businesses, a traditional merchant account would do the job, as long as the payment processor is a high risk specialist. However, if you have a serious problem with fraud-related chargebacks, you would most likely need a 3-D Secure merchant account, in addition to a high risk specialist processor.

Using cardholder authentication, 3-D Secure credit card processing solutions protect you from certain fraud-related types of chargeback. For example, with Verified by Visa, the following chargeback reason codes would not apply to successfully authenticated transactions:

- Reason Code 75 — Cardholder Does Not Recognize Transaction.

- Reason Code 83 — Fraud Transaction — Card Absent Environment.

Furthermore, if you attempted to authenticate your customer and either the issuer or cardholder was not participating in Verified by Visa, you would still be protected from the above chargebacks for authenticated transactions.

This is why at UniBul we offer 3-D Secure merchant account solutions to our clients. Contact us now to learn more about what we can do for you.

Once we’ve reviewed your information, we will reply within hours with details about the credit card processing solution we can offer you. We will review your options and, once we’ve decided on the type of set-up and initiated the application process, we can have you up-and-running in a few days!

How 3-D Secure Works

3-D Secure is an XML-based protocol, which was first developed by Visa under the name Verified by Visa. Soon afterward, other major card brands adopted the protocol and developed their own 3-D solutions. MasterCard’s is called MasterCard SecureCode, JCB’s is called J / Secure and American Express’ is named American Express SafeKey.

All these services authenticate cardholders during an online transaction at 3-D participating merchants. Here is how the process works:

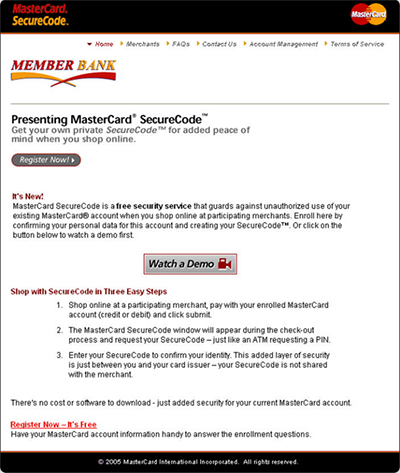

1. At checkout, the merchant shows a brief message to the customer to notify her that she might next be prompted either to activate her card with the relevant 3-D service or, if the account is already activated, to enter her password. Here is how MasterCard SecureCode’s message would look:

The pre-authentication message could also be incorporated into the checkout page, as seen below:

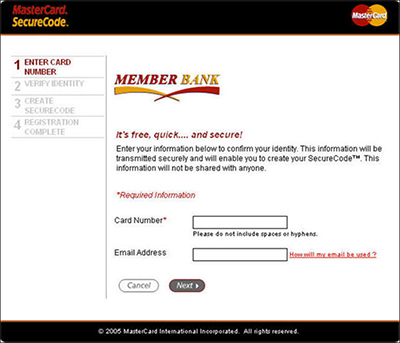

2. If the cardholder would need to activate her 3-D Secure account, she would then be prompted to enter her card number and email address, as shown below:

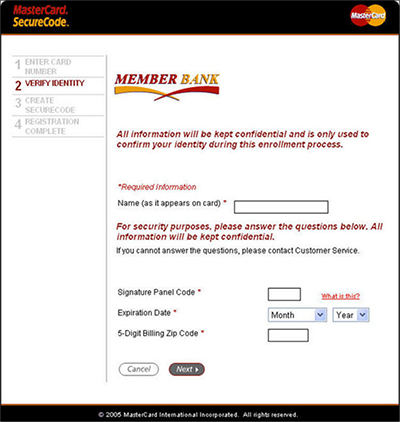

3. Then the cardholder would be asked to verify her identity by entering her name and card security information, as shown below:

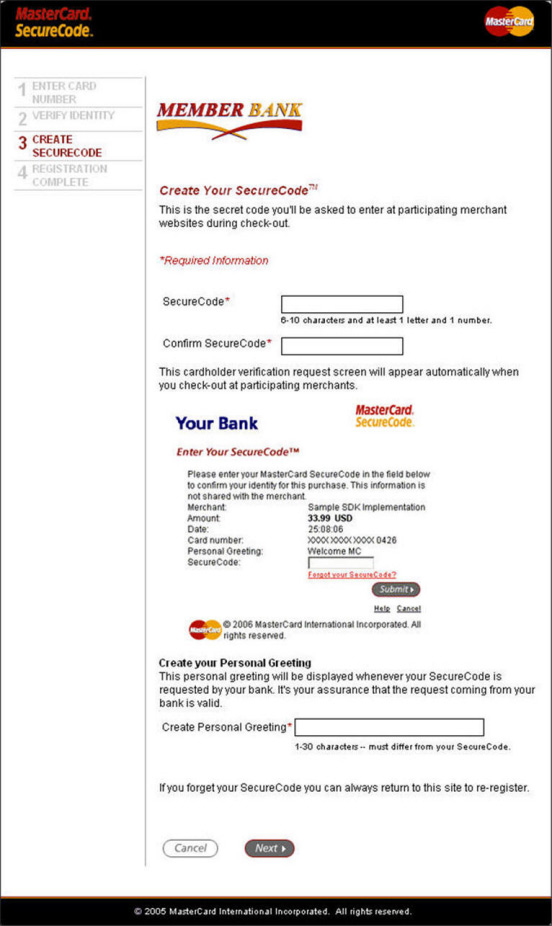

4. Once authenticated, the cardholder would be prompted to create her 3-D account, which would involve the selection of a secret question and response, a personal greeting and a password, as seen below:

5. Once the cardholder’s 3-D Secure registration is complete, she is taken back to the merchant’s checkout page to complete the transaction. From that point on, every time the cardholder uses that card at a merchant participating with the applicable 3-D Secure service, she would be asked to provide her password at checkout. The authentication form would look something like this for MasterCard:

And Visa’s authentication window would looks very much the same:

With our 3-D Secure merchant account you will be able to authenticate your customers and prevent fraud. Send us a note and we will get right back to you with details.

How UniBul Helps You Succeed

When you set up a 3-D Secure merchant account with UniBul, you will be able to process credit card payments quickly and securely. Our payment solutions are designed to save you time and money, prevent fraud and come with a number of great features built in:

1. International payment processing:

- Accept all Visa and MasterCard credit and debit cards.

- Accept payments from customers worldwide.

- Select the settlement currency, which you prefer. Our 3-D Secure merchant account supports settlement in multiple currencies, the more popular of whom are shown below.

- Fast payout. Your funding schedule will be decided during the underwriting process, but we can typically provide weekly payouts, with daily funding available to qualified merchants.

2. Fraud detection:

- Detect and prevent suspicious transactions with our customizable fraud prevention services.

- Address Verification Service (AVS).

- Card security codes (CVV2, CVC 2 and CID).

- The 3-D secure services: MasterCard SecureCode and Verified by Visa.

3. Web-based account management:

- Examine and manage transactions, configure account settings, view and download reports and account statements and more on our merchant reporting website.

- Retrieve the details of the transactions you’ve processed for reporting and reconciliation purposes.

4. Data protection:

- Fully PCI-compliant 3-D Secure merchant account for a secure processing of sensitive customer data.

- With UniBul, you and your customers can be confident that your information is secure.

5. Grow your business:

- Place the free UniBul Verified Merchant Seal on your website for a higher credibility.

- Accept credit and debit cards with a dedicated merchant account to assure your customers that you are a well-established and well-run business.

6. Free, always-on merchant support:

- Online client support center.

- Toll-free merchant support by telephone.

- Online chat feature.

- Well-maintained e-ticket system.

- Fast email support.

7. Recurring and subscription payment processing. Recurring billing is a hugely convenient and easy-to-use service, built into our 3-D Secure merchant account, for submitting and managing subscription-based and installment transactions. Create payment plans manually or from within your web checkout form. Here is what you will be able to do:

- Charge repeat customers using the account information you have stored on file for them.

- Handle ongoing subscription payments automatically. Once a subscription begins, no additional input is required for the duration of the subscription period.

- Dynamic recurring billing will allow you to bill your customers different amounts or on different days each month.

- Achieve greater security by eliminating the need to store sensitive customer information on your computers, limiting the damage from potential data breaches.

- Increase customer loyalty with flexible, time-saving billing plans.

- Reduce costs through the elimination of the need for manual billing. Moreover, recurring billing helps you manage your subscriptions with email notifications upon the expiration of a credit card or subscription plan.

The UniBul Advantage

At UniBul, we specialize in working with high-risk and international businesses and we are always looking for new merchants to sign up. We firmly believe that every business which is properly incorporated and established in its country of origin, and has all the necessary paperwork and licenses, has a right to a merchant account, regardless of the risk category Visa or MasterCard may have placed them in. Our wide network of acquiring banks, located all over the world, ensures that we have a solution available for just about every industry. And at UniBul we will be happy to work with you and set up your 3-D Secure merchant account!

What Our Customers Are Saying

UniBul is ranked based on 159 user reviews.

UniBul enables American and international businesses to accept payments for the things they sell on their websites.